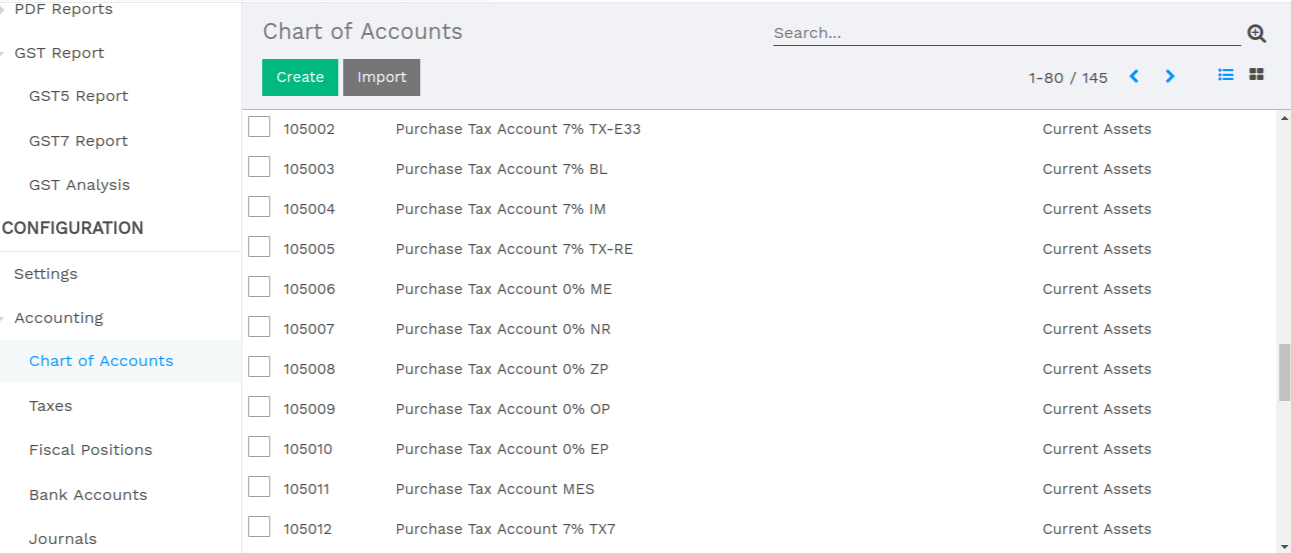

Chart of Accounts for GST Singapore

Tax Accounts configuration based on Singapore Accounting.

Tax Categories

- Categorize your tax codes into five categories by selecting proper value:

- Standard Rates

- Zeroed

- Exempted

- MES

- Out Of Scope

Set Tax group = ‘Zeroed’ for Purchase Tax 7% TX-N33.

Set Tax group = ‘Out Of Scope’ for Sales Tax 0% OS.

Customer Invoice

Customer Invoice with Taxes as per Singapore Localization.

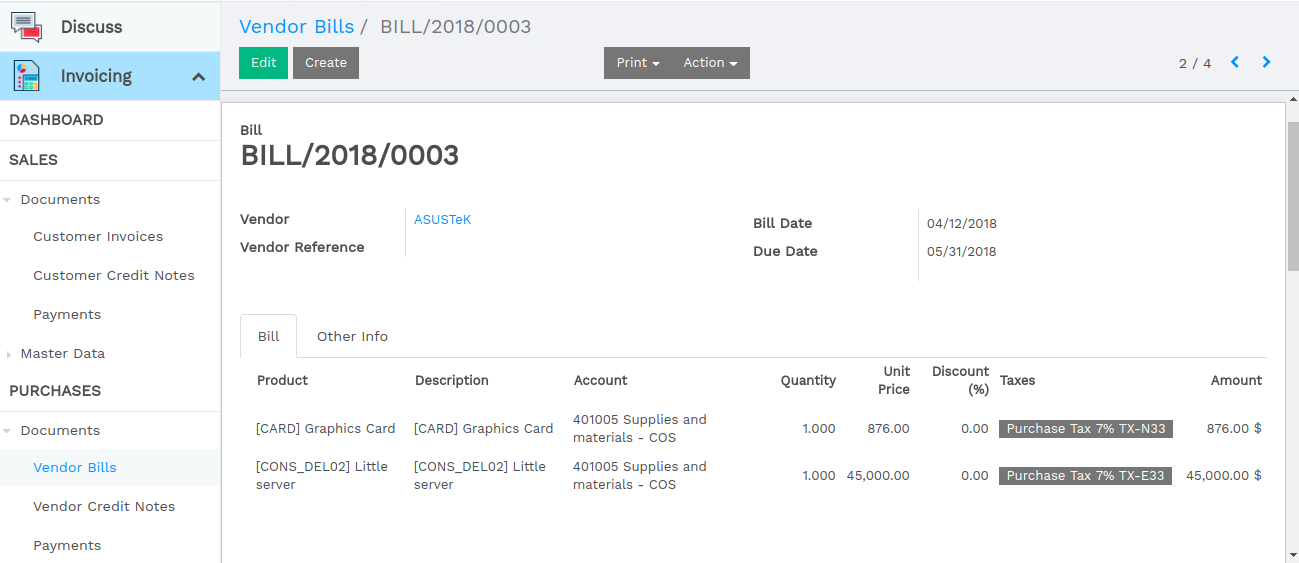

Supplier Invoice

Supplier Invoice with Taxes as per Singapore Localization.

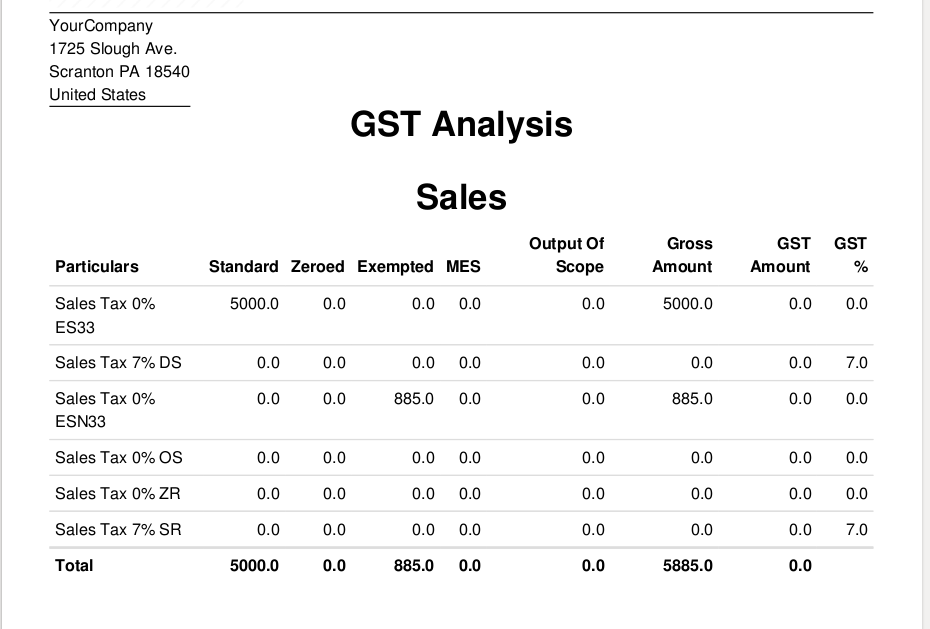

GST Analysis Report

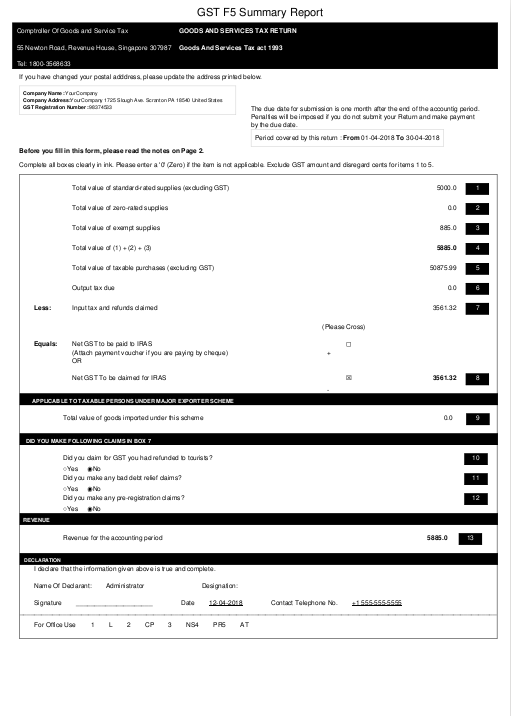

GST-F5 Summary Report

The GST-F5 report includes details such as standard-rated, zero-rated, and exempted, out of scope, mes, purchases and sales in a regulated format.

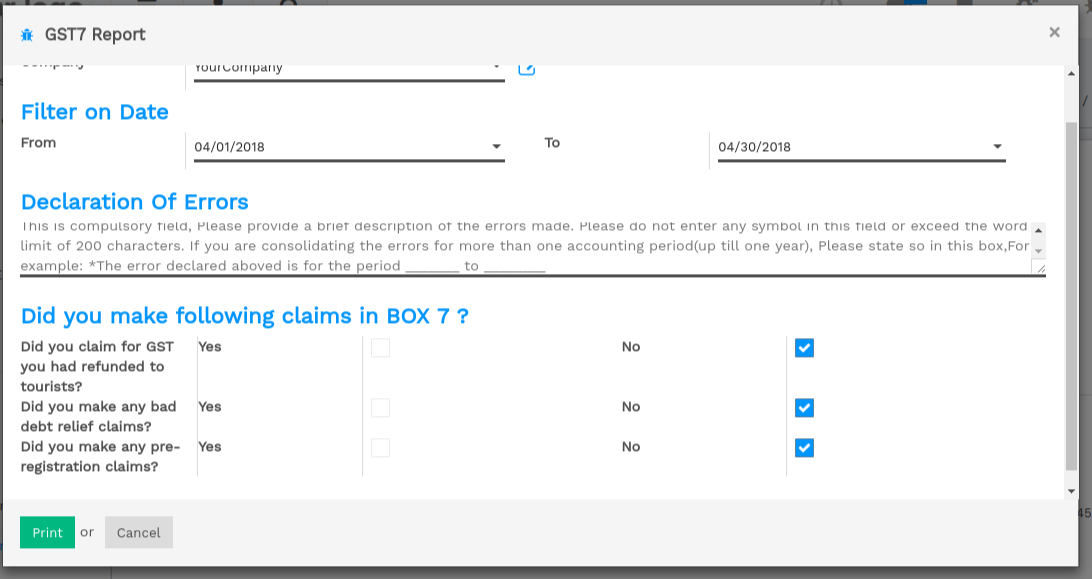

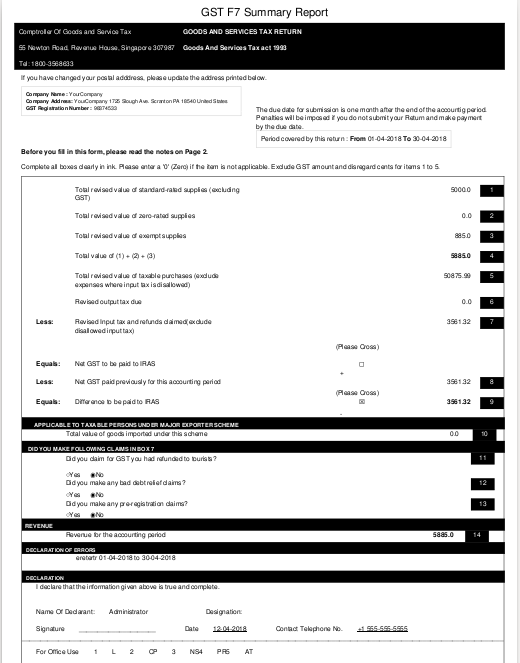

GST-F7 Summary Report

If you have made errors in your submitted GST F5 forms, you should file GST-F7 to correct the errors.