Introduction

Company

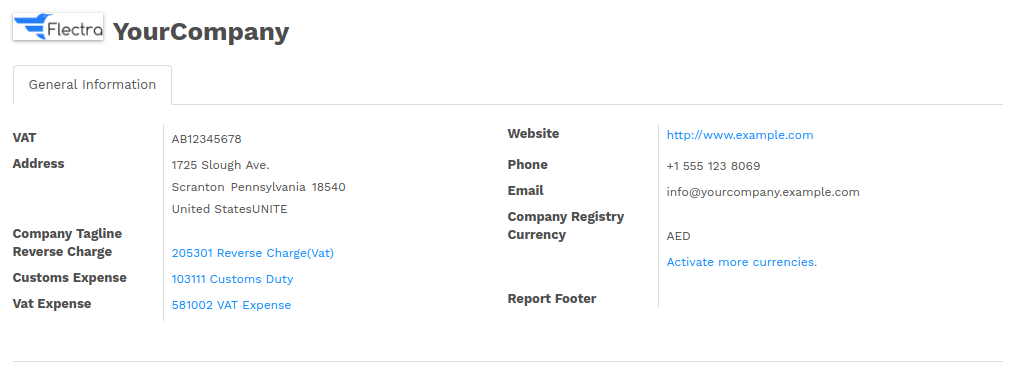

The user is supposed to set such fields under Company. There are three account fields where respective accounts are to be set under Reverse Charge, Customs Expense and VAT Expense.

There is a field labeled as VAT, where user is supposed to set VAT number for respective Company.

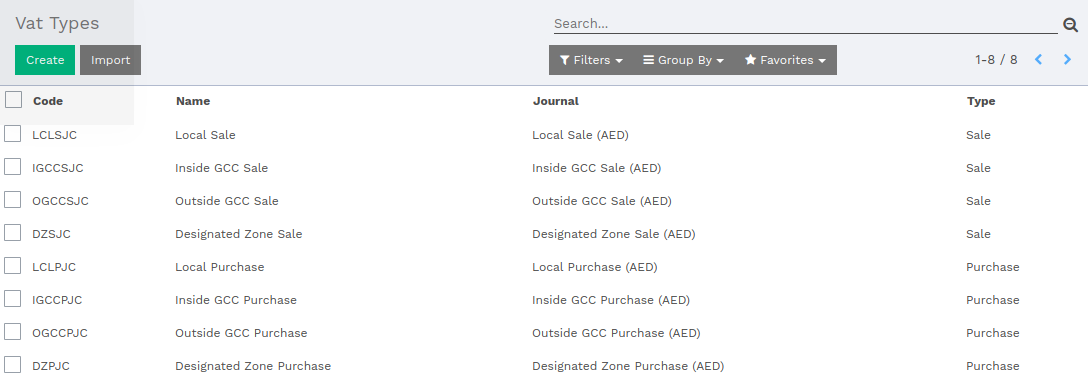

VAT Types

VAT Types are bifurcated in two types, Sales and Purchase.

The major purpose of VAT types is to built a standard report, which will gather all records with its amount according to the VAT Type.

Sales Type

- Local Sale - This type of sales will be displayed in report as Standard Rated Sales.

- Inside GCC Sale - This type of sales will be displayed in report as Sales to customers in VAT implementing GCC Countries.

- Outside GCC Sale - This type of sales will be displayed in report as Exports.

- Designated Zone Sale - This type of sales will be displayed in report as Zero rated domestic sales. If zero percent tax is applied over records then that will be included too.

Purchase Type

- Local Purchase - This type of purchase will be displayed in report as Standard Rated domestic purchases.

- Inside GCC Purchase & Outside GCC Purchase - This type of purchase will be displayed in report as Imports subject to VAT paid at customs.

- Designated Zone Purchase - This type of purchase will be displayed in report as Zero rated purchases.

The user is supposed to set VAT Type under .

In VAT type, the user has to select VAT Type and its Code. The system has given number of VAT types.

Select an appropriate Journal. The user is supposed to select the Type either Sale or Purchase.

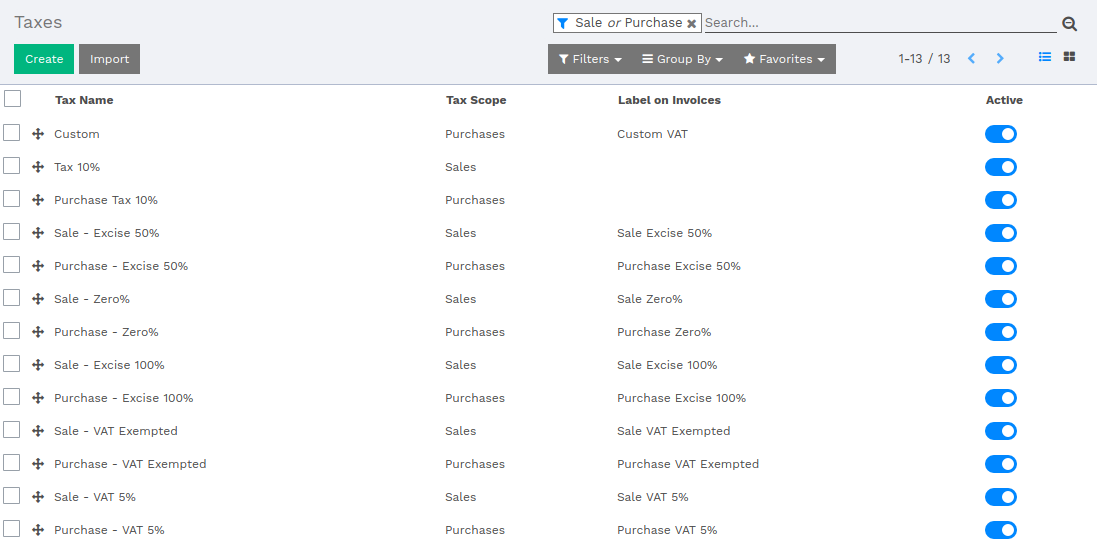

Taxes

Vorlik provides these many pre-defined taxes.

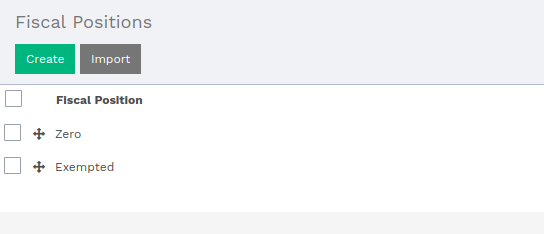

Fiscal Year

This module provides two fiscal year.

Reverse Charge Mechanism

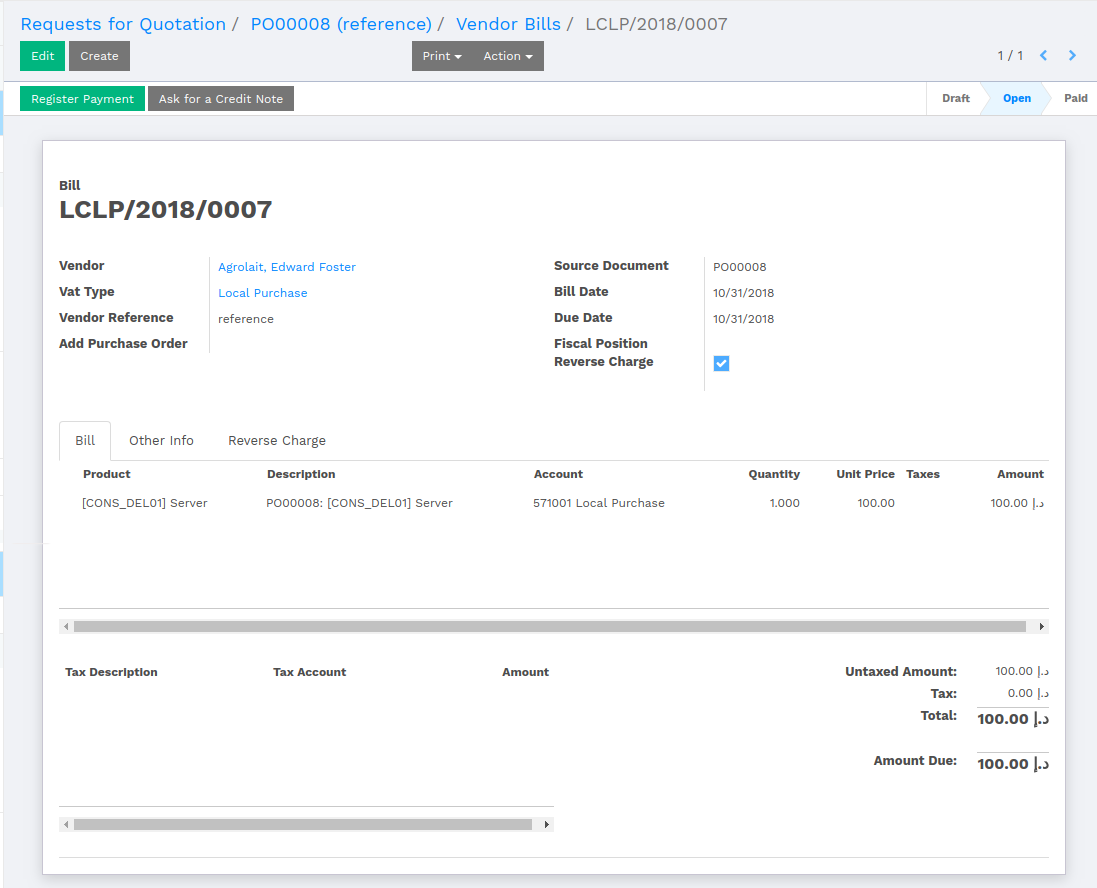

While creating a Purchase Order with marking Reverse Charge, it will be reflected in the Vendor Bill of related PO.

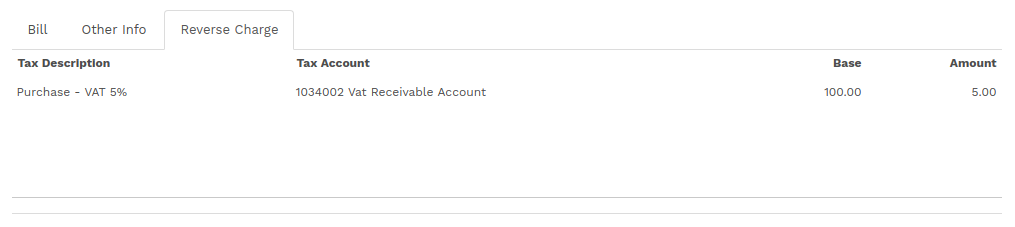

In Vendor Bill, a new tab will be visible labeled as Reverse Charge, which will be having the tax description of the bill.

Once the Vendor Bill is validated, the system will separate the tax from the product line and will show up under Reverse Charge tab.

Report

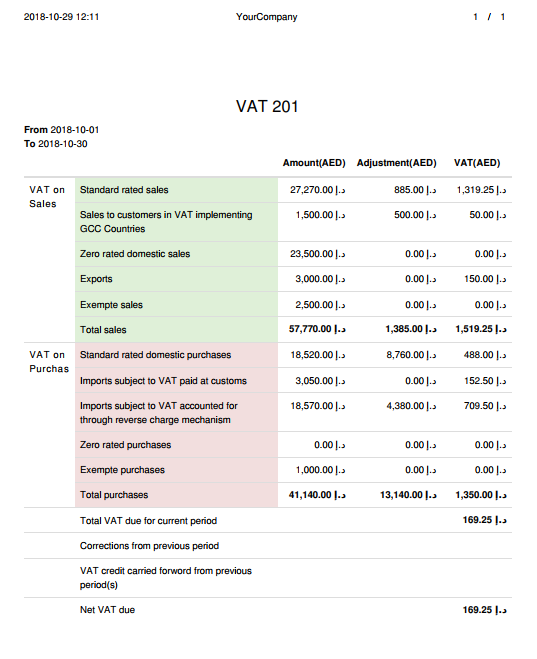

The user can have a report from .

Clicking over VAT 201, the system will open up a window with parameters.

The user is supposed to set the date range, where the system will retrieve records which falls between the given date range.

In the report, the column Amount(AED) shows the amount without tax. The Adjustment(AED) show the amount of the product which is returned. The VAT(AED) column show the final tax applied over the sold products.