To handle payments received by checks. Vorlik support approach so that you can use.

- Undeposited Funds:

- once you receive the check, you record a payment by check on the invoice. (using a Check journal and posted on the Undeposited Fund account) Then, once the check arrives in your bank account, move money from Undeposited Funds to your bank account.

We recommend this approach as it is more accurate (your bank account balance is accurate, taking into accounts checks that have not been cashed yet).

Undeposited Funds

Configuration

- Create a journal Checks

- Set Undeposited Checks as a defaut credit/debit account

- Set the bank account related to this journal as Allow Reconciliation

From check payments to bank statements

The first way to handle checks is to create a check journal. Thus, checks become a payment method in itself and you will record two transactions.

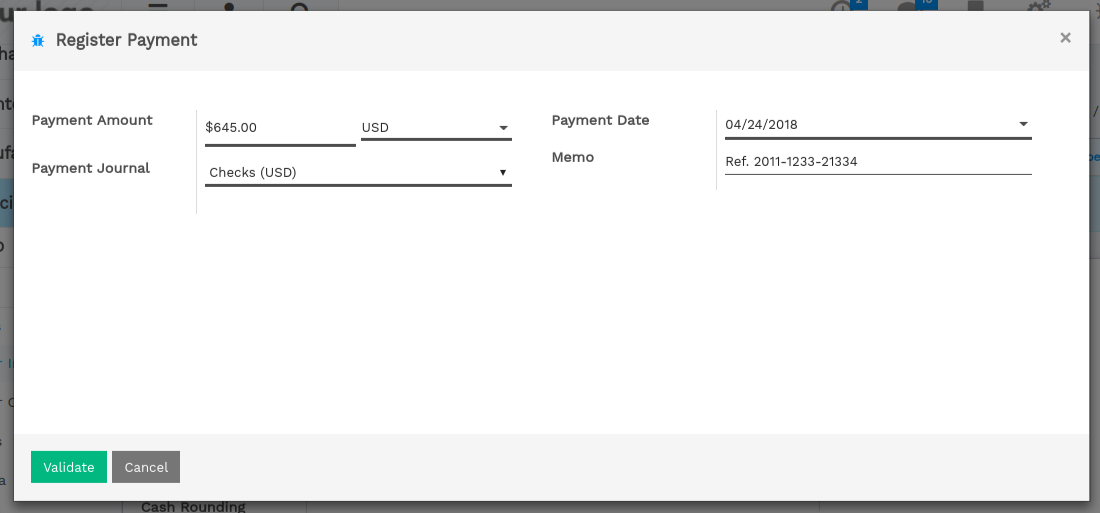

Once you receive a customer check, go to the related invoice and click on Register Payment. Fill in the information about the payment:

- Payment method: Check Journal (that you configured with the debit and credit default accounts as Undeposited Funds)

- Memo: write the Check number

This operation will produce the following journal entry:

| Account | Statement Match | Debit | Credit |

|---|---|---|---|

| Account Receivable | 100.00 | ||

| Undeposited Funds | 100.00 |

The invoice is marked as paid as soon as you record the check.

Then, once you get the bank statements, you will match this statement with the check that is in Undeposited Funds.

| Account | Statement Match | Debit | Credit |

|---|---|---|---|

| Undeposited Funds | X | 100.00 | |

| Bank | 100.00 |

If you use this approach to manage received checks, you get the list of checks that have not been cashed in the Undeposit Funds account (accessible, for example, from the general ledger).

Tip

You may also record the payment directly without going on the customer invoice, using the menu . This method may be more convenient if you have a lot of checks to record in a batch but you will have to reconcile entries afterwards (matching payments with invoices)