In Vorlik, every transaction is recorded in the default currency of the company. Reports are all based on the currency of the company. But for transactions occurring in another currency, Vorlik stores both the value in the currency of the company and the value in the currency of the transaction.

When you have a bank account in a foreign currencies, for every transaction, Vorlik stores two values:

- The debit/credit in the currency of the company

- The debit/credit in the currency of the bank account

Currency rates are updated automatically using yahoo.com, or the European Central bank web-services.

Configuration

Activate the multi-currency feature

In order to allow your company to work with multiple currencies, you should activate the multi-currency mode. In the accounting application, go into make sure the Multi-currencies box is ticked. Provide a Currency Exchange Gain / Loss journal, then click on Save.

Configure currencies

Once the Vorlik is configured to support multiple currencies, you should activate the currencies you plan to work with. To do that, go the menu . All the currencies are created by default, but you should activate the ones you plan to support. (to activate a currency, check his active field)

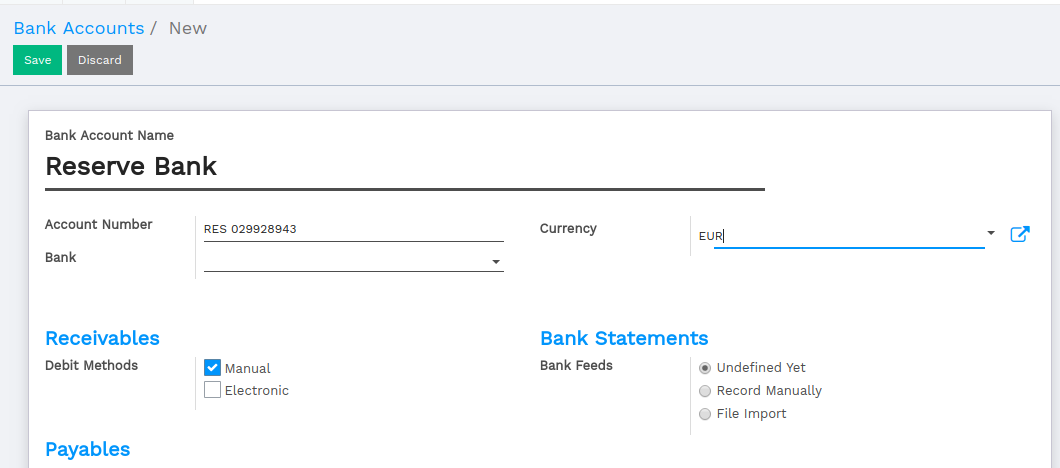

Create a new bank account

In the accounting application, we first go to , and we create a new one.

Once you save this bank account, Vorlik will create all the documents for you:

- An account in the trial balance

- A journal in your dashboard

- Information about the bank account in the footer of your invoices if checked the box Show in Invoices Footer

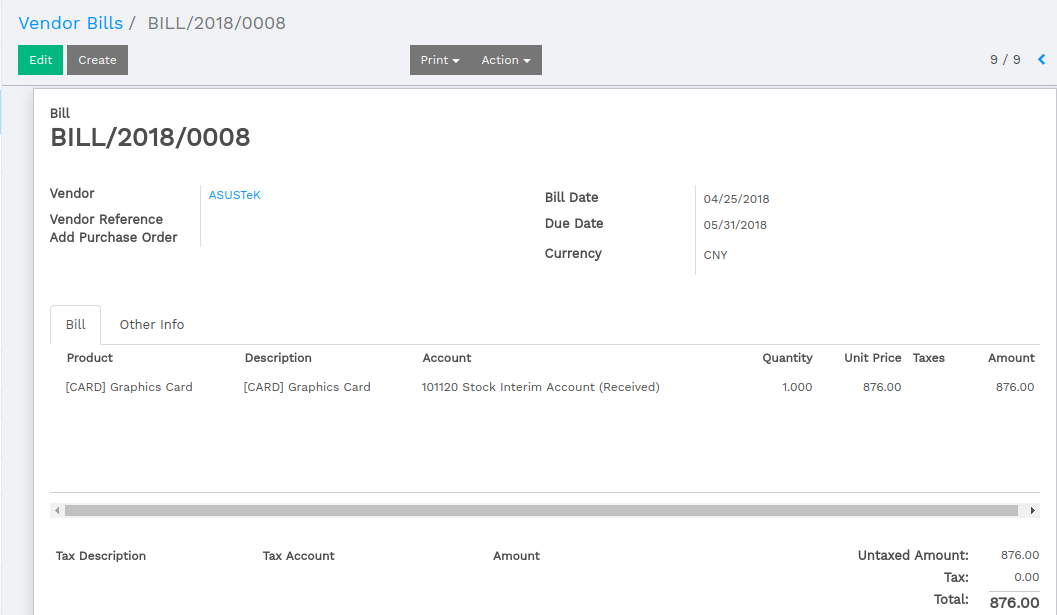

Example: A vendor bill in a foreign currency

Based on the above example, let’s assume we receive the following bill from a supplier in China.

In the , this is what you could see:

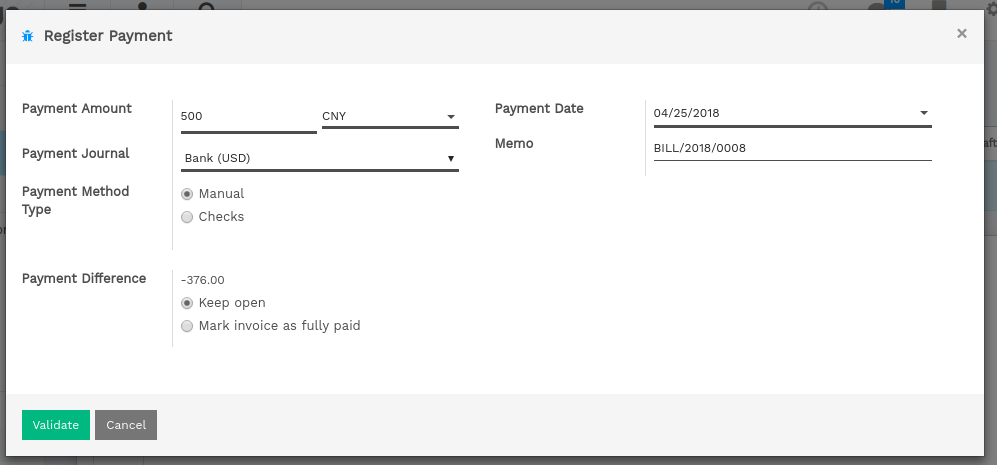

Once you are ready to pay this bill, click on register payment on the bill to record a payment.

That’s all you have to do. Vorlik will automatically post the foreign exchange gain or loss at the reconciliation of the payment with the invoice, depending if the currency rate increased or decreased between the invoice and the payment date.

Note that you can pay a foreign bill with another currency. In such a case, Vorlik will automatically convert between the two currencies.